Management Information and Technology: Absorption-costing recap

Kit Kerr CA offers a recap on the principles of absorption-costing, one of the key concepts introduced in TC Management Information and Technology (MIT).

What is Absorption Costing?

Absorption Costing is one of the key concepts introduced in TC Management Information and Technology (MIT). It is the method of allocating costs to units of goods produced, which is preferred by IAS2 when valuing stock.

Absorption costing is a method by which fixed overheads, which have already been apportioned and reapportioned into the production departments of an organisation, are then shared between the units produced. This is done using the Overhead Absorption Rate.

How is the Overhead Absorption Rate calculated?

The way that the Overhead Absorption Rate (OAR) is calculated depends on whether the entity has manufactured more or less units than expected in a period.

If actual production is equal to budgeted production, the period-end OAR is used. This is calculated as:

- Actual fixed production overheads / budgeted basis

If actual production is greater than budgeted production, the actual OAR is used. This is calculated as:

- Actual fixed production overheads / actual basis

If actual production is lower than budgeted production, the period-end OAR is again used.

All OAR calculations are based on a production basis, not a sales basis. The basis usually used would be units, but may also be based on others such as labour hours or machine hours.

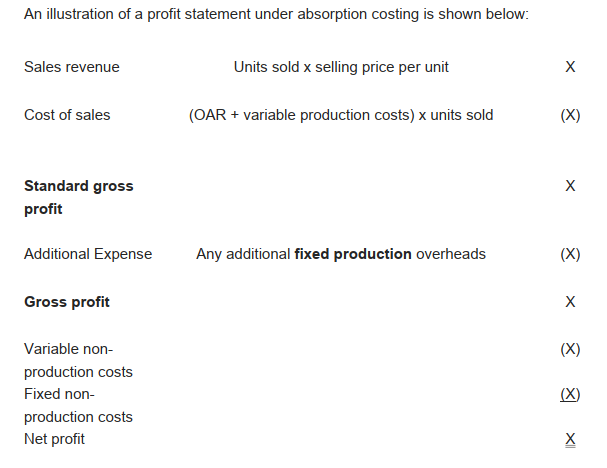

How is the profit then calculated under absorption costing?

To then calculate the profit under absorption costing, the cost of sales per unit must be know. This is calculated as the variable production costs plus the OAR per unit.

How is stock valued using absorption costing?

To value stock, a simple calculation is needed.

- Closing stock value = closing stock (units) x (OAR + variable production costs per unit)

Absorption costing is often an area which students struggle with. Hopefully this recap helps to clarify the detail and make it more understandable.