In detail: Key announcements in the spring Budget 2024

Spring Budget in detail: NIC cut welcome for taxpayers, but Chancellor fails to provide lifeline for SMEs

On the key announcements within the spring Budget, Bruce Cartwright CA (ICAS Chief Executive) said:

- The Chancellor has again failed to offer enough support for small and medium sized businesses (SMEs), which make up 99.9% of UK businesses and are the life blood of the economy.

- We applaud the Chancellor for supporting those on lower incomes by cutting employee’s national insurance rates by 2% across the UK, as this puts money into the pockets of working people. This is worth £450 each year for someone on the average salary.

- We welcome the move to cut the NIC payments for the self-employed from 8% to 6% which is worth around £350 pa for someone on the average salary.

- By continuing to freeze the personal allowance, the government is putting more pressure on low paid workers, because as their earnings rise above the frozen threshold of £12,570, they will start to pay income tax.

- The Chancellor was right to increase the high-income child benefit charge (HICBC) threshold to £60,000 as part of a broader reform to the scheme.

- The government has missed another opportunity today to reform the UK Apprenticeship Levy. Levy funds, which are currently paid by large employers whose pay bill is over £3m pa, are still under-utilised, and the revenue wasted.

Our experts have provided further detail and analysis on the announcements below.

On changes to the high income child benefit charge, Chris Campbell (Head of Tax Practice and Owner Managed Business Taxes at ICAS) said:

“We welcome the increase in the high income child benefit charge (HICBC) threshold from £50,000 to £60,000 from 6 April 2024, as part of broader reform to the scheme. The taper rules will also be changed so that child benefit is only withdrawn once a taxpayer has an income of £80,000.

"HICBC has often been seen as an unfair tax, as single parent households and households where one taxpayer has an income over £50,000 (but the other has a low income) aren’t currently entitled to the full benefit, whereas households with two incomes under £50,000 are entitled despite having a higher overall household income. The threshold hasn’t been increased since HICBC was introduced in 2013, so the increase announced today could have a significant and positive impact on struggling families’ finances in the short term. We look forward to reviewing the details of how HICBC will apply based on a household’s income in the longer term. The higher threshold will reduce the number of households affected by HICBC, with a knock-on impact on the marginal rates of income tax for earners at that level."

On full expensing for companies, Chris Campbell (Head of Tax Practice and Owner Managed Business Taxes at ICAS) said:

“Given the announcement in the Autumn Statement that full expensing would be made permanent, it was unlikely that the Chancellor would make significant changes in this Budget. Full expensing is not currently available on leased assets, so the Chancellor has announced a consultation to enable full expensing to potentially be claimed on such assets. While we welcome this, we believe that the Chancellor should have gone further by extending full expensing to include expenditure on used plant and machinery. Our members tell us that supply issues can affect the availability of new plant and machinery within an acceptable timescale. While the annual investment allowance (AIA) is available, this is limited to £1m of qualifying expenditure per year. This will be sufficient for most businesses, but there will be many larger businesses who won’t receive upfront tax relief in the year of purchase.”

On tax reliefs for small businesses, Chris Campbell (Head of Tax Practice and Owner Managed Business Taxes at ICAS) said:

“While there were reductions in the Class 4 national insurance rate from April 2024 and a modest increase in the VAT registration threshold to £90,000, there were very few measures in the Budget to support small businesses. The Chancellor seemed to imply that he would have liked to have gone further over the long term. We would welcome further debate about simplifying the tax system to make it more easily understandable.”

On the tax payable by property businesses, Chris Campbell (Head of Tax Practice and Owner Managed Business Taxes) at ICAS said:

“There was a mixed bag of announcements on property income in this Budget. Furnished holiday lettings (FHL) have benefited from the tax rules on trading income - in terms of capital allowances on furniture and equipment additions, a reduced capital gains tax rate of 10% where business asset disposal relief is available and the ability to claim business asset rollover relief and holdover relief. Profits from a FHL business can also currently be treated as income for pension purposes.

"The Chancellor announced the abolition of the FHL from April 2025, which will treat FHL properties the same as other residential properties. There is good news for property investors, as the higher rate of capital gains tax on residential property will reduce from 28% to 24% from 6 April 2024 (with no changes to the 18% rate for capital gains on residential property payable at the UK basic rate)."

On inheritance tax, Chris Campbell (Head of Tax Practice and Owner Managed Business Taxes) at ICAS said:

“While the Chancellor did not refer to it in his speech, we are pleased to hear that the government has announced that the scope of agricultural property relief from inheritance tax will be extended from 6 April 2025 to include land managed under an environmental agreement. We recently called for this in a joint letter to the Financial Secretary to the Treasury with the Law Society of Scotland and the Association of Taxation Technicians and would welcome the opportunity to have further discussions with HM Treasury and HMRC working group on the broader areas of the tax treatment of ecosystem service markets where extra clarity is needed.

"We do however feel that the Chancellor missed an opportunity to consider simplification measures such as merging the nil rate band and residence nil rate band, so that it would no longer necessary for an estate to include a residence being left to a direct descendant in order to qualify for a combined nil rate band of £500,000 (£1 million per couple).”

On pension reform, Christine Scott (Head of Charities and Reporting at ICAS) said:

“The UK government’s ambitious pension reform programme, which aims to improve retirement incomes and boost the UK economy, was restated in today’s Budget.

"As defined contribution (DC) saving becomes the norm for most savers, The Pensions Regulator (TPR) and the Financial Conduct Authority will expect occupational DC schemes and contract-based arrangements to provide value for money, with a focus on overall returns rather than fees and charges. The government’s commitment to a ‘pension pot for life’ was reiterated following public consultation, even though the proposals weren’t enthusiastically received by many in the pensions industry. Having a ‘pension pot for life’ creates complexity for schemes and employers, but it should reduce the future proliferation of small pots which could boost individual pension pots and retirement incomes. Key to the success of this policy will be good governance, so that savers are confident that their funds are properly stewarded, especially as the scope for employer oversight of their savings is diminished. TPR’s new General Code of Practice, due to come into effect later this month, focuses on schemes being well governed.”

On the VAT threshold, Susan Cattell (Head of Tax Technical Policy at ICAS) said:

"The Chancellor must be hoping that an increase in the VAT threshold will encourage small businesses to expand, rather than restricting their growth to avoid entering the VAT regime. The frozen threshold has caused significant ‘bunching’ of businesses keeping their turnover just below the threshold, for example, by not taking on an extra staff member or declining additional contracts. Although the Treasury commented that around 28,000 small businesses will be taken out of paying VAT altogether, the small increase to £90,000 from £85,000 is unlikely to have a significant overall impact on the problem and may simply slightly shift the point at which ‘bunching’ occurs. However, a bigger increase in the threshold would have been expensive. Other options, such as a reduction in the threshold, accompanied by some form of smoothing mechanism to ease the transition into the VAT regime, would have increased complexity and probably have been unpopular with small businesses."

On cuts to national insurance, Justine Riccomini (Head of Employment and Devolved Taxes at ICAS) said:

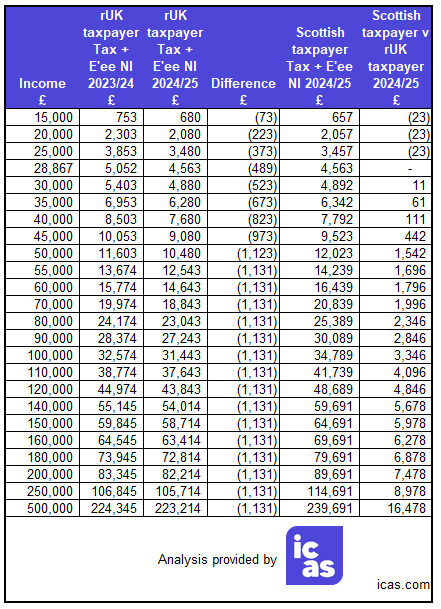

"National Insurance cuts for the employed and self-employed are always welcomed by workers, as it gives them more of their earnings back and improves their spending power. Today's 2% cut in NICs for employed and self-employed workers is extremely welcome given that the Chancellor cut NICs by 2% in the Autumn Statement last year for employees from 1 January 2024 and by 1% for the self-employed from 6 April 2024. Overall, this 4% cut for the employed represents savings of around £900 per tax year for the average full-time worker - something which will really help those who are lower paid and need the money for rising household costs and childcare. For the self-employed, a further 2% cut added to the 1% announced in the Autumn Statement represents an annual saving of £525.

"Cuts to NICs are not a devolved matter, so have a UK-wide impact. Note that NICs cuts don't affect pensioners or those who have investment income, rather than work-related earnings. We are, however, disappointed to see that the Chancellor has not chosen to offer small businesses a bit of a break in these tough economic times by lowering employer's NICs rates.”

On personal allowance, Justine Riccomini (Head of Employment and Devolved Taxes at ICAS) said:

"Announcements were made by both Rishi Sunak as Chancellor in March 2021 and by Jeremy Hunt in the Autumn Statement 2022 that the Personal Allowance levels would be frozen at 2021-22 levels until 2025-26 and 2027-28 respectively. It therefore comes as no surprise that the UK Personal Allowance (PA) has remained the same. The decision not to change the UKPA does, however, affect more and more low paid workers each year as their earnings rise above the threshold of £12,570 and they start to pay income tax - something known as ‘fiscal drag’. Some pensioners may also be brought into tax on their pension earnings due to this. With the rise in National Minimum Wage levels on 1 April to £11.44, someone working a 40 hour week will earn £457.60 a week, or £23,795 a year including paid holidays. If they are entitled to a PA, they will pay tax at 20% in England and Wales on £11,225 of that salary = £2,245 per year.”

On the impact on Scottish/Welsh taxes, Justine Riccomini (Head of Employment and Devolved Taxes at ICAS) said:

"The cuts made today to NICs will affect all UK taxpayers equally, as NICs is not a devolved matter, but is instead reserved to the Westminster Government. Scottish and Welsh taxpayers will therefore benefit from the measure, especially in terms of the marginal rate anomalies which exist for higher and top rates, which will now sit at 50% and 67.5% respectively - they will of course still be subject to their own country's tax rates and bands, which remain unaffected by today's Budget measures. It is worth noting that the cut in NICs will not generate any additional so-called ‘Barnett consequentials’ for the Scottish budget as a standalone measure. If the Chancellor had decided to cut the rate of income tax in the rest of the UK, then through the Block Grant Adjustment, the Scottish Government would have received additional revenue to reflect any reduction in revenues on a pro-rata basis.”

On HMRC services, David Menzies (Director of Practice at ICAS) said:

“Sadly, the Chancellor has again failed to listen to our calls for increased resources for HMRC. He announced resources for debt collection, but no additional resources to improve HMRC services. Our members frequently tell us of their frustrations at the poor quality of HMRC’s digital services, combined with the long delays in calls being answered. HMRC tells us the solution is digital, but the government needs to invest in expanding the range of tasks that can be done electronically by the public and by tax agents.”

On standards in the tax advice market, David Menzies (Director of Practice at ICAS) said:

“We note that the government will be publishing a consultation both on options to strengthen the regulatory framework in the tax advice market, and on requiring tax advisers to register with HMRC if they wish to interact with HMRC on a client’s behalf. The government will also explore making it quicker and easier for tax advisers to register with HMRC. We look forward to engaging with HMRC and the government to ensure that any proposals are well founded and avoid unintended consequences for taxpayers and their agents.”