Determining the usefulness of real-time information

ICAS has funded and published research into the usefulness of real-time and high-frequency information by analysts and investors.

Advances in technology, an explosion in the volume and variety of information available, and fundamental changes in the way in which we utilise data are transforming accounting and reporting.

An example of this shift is in the corporate reporting landscape, where corporate reports that only include historical financial information are no longer considered sufficient to meet the information needs of all stakeholders. We increasingly live in a world of Big Data and massive computer processing power, where data aggregators and media channels have the capability to obtain and disseminate information about company performance well before the company itself publishes its results. But is this faster/more frequent information actually useful, utilised and desired for decision-making by key stakeholders?

Research aims

Against this background, this interview-based research project by Subhash Abhayawansa (Swinburne University of Technology), Mark Aleksanyan and Ioannis Tsalavoutas (University of Glasgow, Adam Smith Business School) and Kenneth Lee (London School of Economics and Politics), specifically set out to:

- Gain an evidence-based understanding of professional investors’ and financial analysts’ perceptions and usage of real-time and quick-time data in their practice of analysis of company performance, equity valuation and investment decision-making;

- Assess analysts’, investors’ and other stakeholders’ current and future perceived demand for real-time information in general, and quick-time corporate reporting information in particular; and

- Assess users’ perspectives on the need for a new corporate reporting and assurance paradigm, and/or future regulation of real and quick-time data.

By addressing these objectives, the study aims to inform a broader debate about the relevance of the current corporate reporting paradigm (regulations, reporting standards and corporate reporting practices) in the era of real-time and big data, and steer future research in this field.

Key takeaways

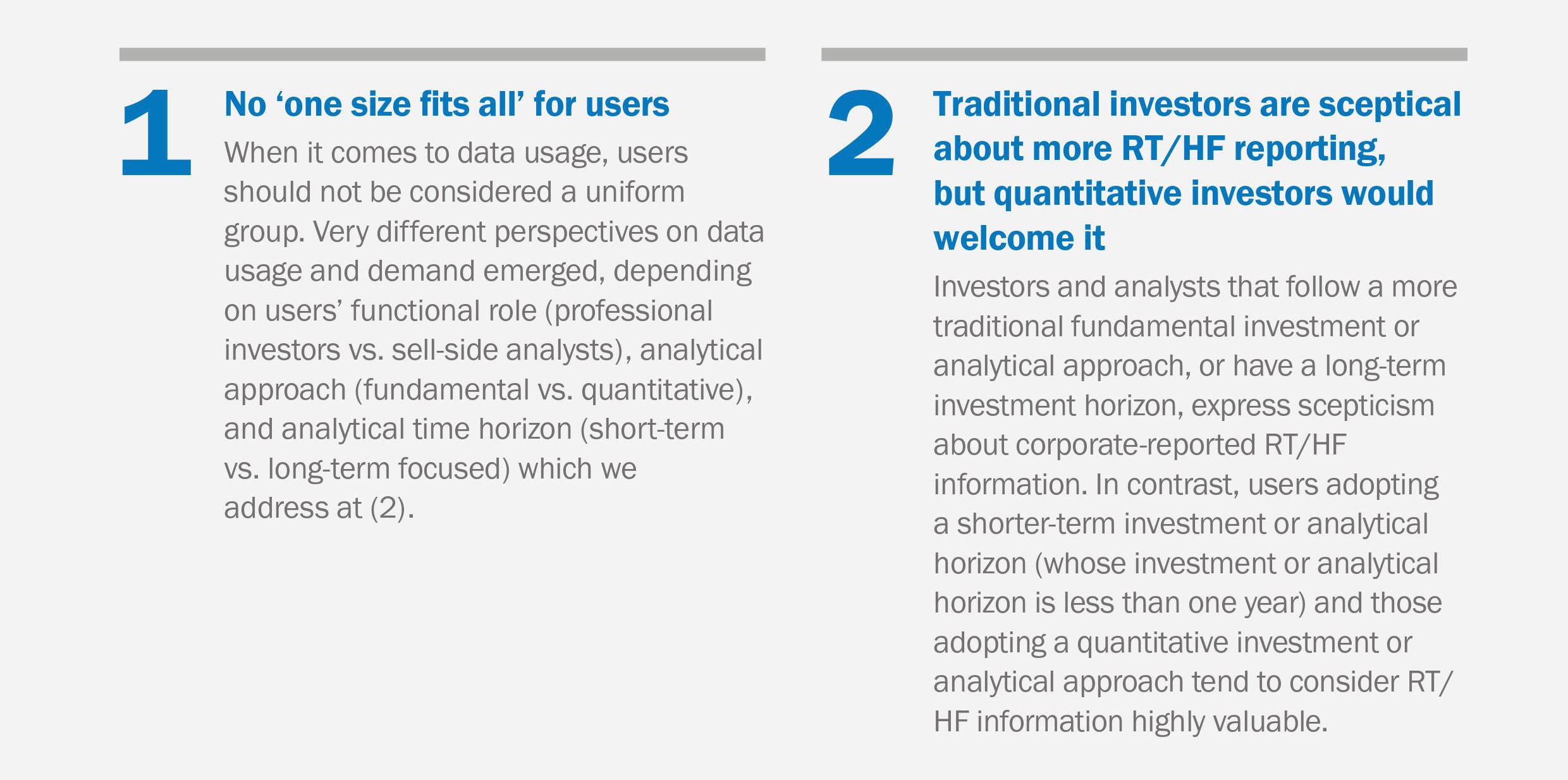

Some of the key findings from the project were: