Insights from bankers for CBILS and CLBILS applications during COVID-19

Insights from bankers for successful CBILS lending applications

This article shares informal feedback collated from a selection of CBILS approved UK lenders on some of the key takeaways identified, as they have worked through this busy application period. This is grouped into common areas where challenges arise.

The focus is mainly on the CBILS loan product but can just as easily be transferred to its larger business cousin, CLBILS. The Bounceback loan scheme (BBLS) is far more straightforward with a simplified checklist of requirements (many self-certified) so any issues in approvals are likely down to process or data limitations rather than approach.

Since its launch on 24th March 2020, the Coronavirus Business Interruption Loan Scheme (CBILS) has attracted mixed feedback. Some businesses have reported a very quick turnaround, light touch credit processes and attractive terms (both interest rates and level of restrictive covenants). Others however remain unable to obtain approvals after many weeks/months and are frustrated with their banks, with little confidence that loans will ultimately ever be approved.

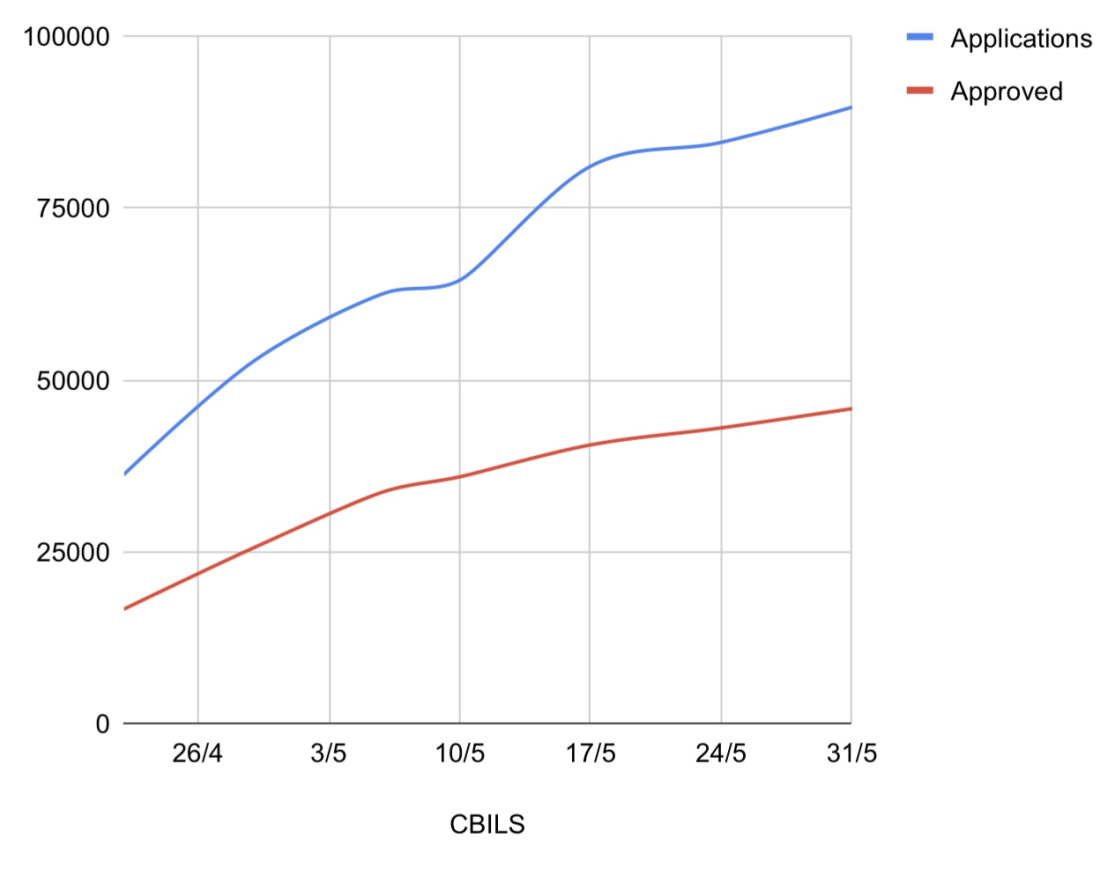

Chart 1: Applications submitted vs Applications Approved

CBILS approval rates appear to have settled at around the 50%-55% level, despite the level of applications slowing (applications were running at more than 16,000 per week at the end of April but have reduced to less than 5,000 a week by the end of May). This significant level of submitted, but unapproved, applications suggests an expectation gap between lenders and their clients.

Qualifying - bank internal requirements

1.Viable borrowing proposal

The British Business Bank (BBB) terms state that businesses applying for CBILS must “have a borrowing proposal which the lender would consider viable, were it not for the current pandemic”.

What this means in practice is that all of a bank’s usual lending criteria apply, so if a bank was a conservative lender before COVID, it will continue to be for CBILS purposes. Furthermore, where some banks in normal circumstances are able to flex some lending policies following additional diligence, in the case of CBILS it is the adherence to policies that justifies a loan as being viable. As viability is driven by existing policy, there will certainly be differences in risk appetite across participating banks so having an application rejected by one lender does not rule out applying to an alternative.

An interesting implication of the reliance on core policy however is that banks may ultimately find it more difficult to offer a CBILS loan than they might a standard corporate loan. This may appear counterintuitive to many prospective borrowers given the CBILS option includes an 80% Government guarantee.

2. - Loan sizing

Applicants may find that on applying, a loan is scaled back from the requested amount. As noted above, banks may have existing policies directing maximum loan sizes based on a business’s turnover, salary costs or a multiple of Earnings before Interest, Tax and Depreciation (EBITDA). CBILS will not enable a bank to go against its existing policies.

3. - Profitability

A common lending policy is to require at least 2 years positive EBITDA. This requirement is likely to trip up a number of businesses that were investing in growth before COVID-19 and naturally running an operating loss. In these cases, it is key to help the bank by providing an analysis of your core versus growth costs in order to demonstrate an underlying EBITDA. Although the decision-making process will vary across different banks, this exercise can help to facilitate a bank’s decision to provide debt to a ‘loss making’ business.

Qualifying - Undertaking in Difficulty (UID)

The BBB have restricted CBILS lending to an Undertaking in Difficulty (UID) as this would be classified as disallowed State Aid. An issue has been identified where businesses with Loan Notes in their group structure are falling foul of this issue as they trigger the UID tests. Most banks have therefore treated Shareholder Loan Notes as debt and as a result, many private equity (PE) backed businesses are unable to access CBILS.

While Loan Notes in PE transactions are very much debt-like, if the terms of the Loan Notes are sufficiently subordinated in terms of when they are required to be repaid (including where they would rank in an insolvency) then a senior bank lender could reasonably take the view that they would not be a threat to repayment of the bank debt and treat the Loan Notes as if they were equity.

A small number of lenders are now trying to be more flexible on this point, where they can prove that a Loan Note is subordinated (both in insolvency and by repayment date). If interest is accrued then both the principle and accrued interest could be removed from creditors and classed as equity which can have a significant effect on net assets for lending decision-making purposes. Speak to your lender on this matter to find out their interpretation.

Shareholder discussions

Although not part of the CBILS rules, banks do expect to discuss with loan applicants how shareholders are intending to participate in supporting a business through COVID-19. In particular, where a business has taken a number of mitigating reliefs (such as rent relief, rate relief, furloughed staff, deferred HMRC payments, stretched other creditors etc.) the bank will naturally be interested to see that shareholders demonstrate their commitment to the future of the business when seeking government guaranteed lending.

Responsible lending / directors’ duties

CBILS guidance to banks is silent on how banks should work with a business that has undergone a permanent detrimental change to its business model as a result of COVID-19. Subsequently, even though a business might meet the lending criteria of being viable pre-COVID-19, it may now be considered inappropriate to forward a loan in the knowledge that the business would ultimately be unable to repay (this is also an essential consideration for directors when taking on a new financial commitment).

Linked to the above point, banks may request forward-looking statements to demonstrate an applicants’ repayment ability. On the face of it, this may appear to be against the BBA’s CBILS guidance, however banks still have an overriding requirement to maintain responsible lending practices.

So should I apply?

It is apparent that despite expectations of many businesses that CBILS should be an easier approval process for banks as the loans are largely Government guaranteed, the additional rules and governance surrounding CBILS loans can end up being more restrictive than for a standard corporate loan as banks have their own corporate policy to adhere to as well as the CBILS terms. By being prepared with up to date information and helping your bank to adhere to the additional CBILS rules, a business will maximise its chances of a successful application.