Important updates for companies and auditors: COVID-19

A joint statement by the FCA, FRC and PRA announced a series of actions to ensure information continues to flow to investors and support the continued functioning of the UK’s capital markets.

This includes:

1.A statement by the FCA allowing listed companies an extra 2 months to publish their audited annual financial reports.

2.Guidance from the FRC for companies preparing financial statements in the current uncertain environment. This is complemented by guidance from the PRA regarding the approach that should be taken by banks, building societies and PRA-designated investment firms in assessing expected loss provisions under IFRS9.

3.Guidance from the FRC for audit firms seeking to overcome challenges in obtaining audit evidence.

FRC

The FRC have also issued guidance for companies preparing financial statements and a bulletin for auditors covering factors to be taken into account when carrying out audits during the current COVID-19 crisis.

These unprecedented times may require increased disclosures of any uncertainty surrounding the entity’s ability to continue as a going concern. There may also be an increase in the number of modified audit opinions issued than under normal circumstances as a result of the auditor’s inability to obtain the necessary audit evidence.

Corporate Governance

The company guidance highlights key areas for board attention to help maintain strong corporate governance and high-level guidance on the most pervasive issues when preparing annual/other corporate reports.

Key corporate governance messages are to:

- develop and implement mitigating actions and processes to maintain an effective control environment, addressing key reporting and other controls which boards may no longer be able to place reliance on;

- consider how reliable and relevant information can be secured on a continuing basis; and

- pay attention to capital maintenance, ensuring that sufficient reserves are available when the dividend is paid, not just proposed; and sufficient resources remain to continue to meet the company’s needs.

Forward looking assessments and reporting

Forward-looking assessments and estimates are particularly challenging at present. The guidance helps board focus on areas of reporting of most interest to investors; and to encourage them to provide clarity on the use of key forward-looking judgements. This includes:

- narrative reporting – it should be entity specific and offer insight into the board’s assessment of business viability and assumptions used

- going concern and material uncertainties – the basis of significant judgements and matters to consider

- increasing importance of providing information on significant judgements and sources of estimation uncertainty and assumptions

- judgement, appropriate reporting response after reporting dates and disclosures.

Issues for boards

Boards are advised to consider and ensure plans are in place to address:

- management information disruptions

- risk management and internal control systems may have been relaxed or become unworkable – boards are encouraged to monitor changes and introduce alternative mitigating controls

- dividends and capital maintenance

- corporate reporting - boards cannot predict the extent, duration and economic consequences of COVID-19 but it is reasonable to expect companies to articulate their expectations of the possible impacts on their specific business in different scenarios, including explaining the company’s resilience in face of uncertainty, the key assumptions and judgements used and availability of cash.

- strategic report and viability statement

- financial statements including:

- going concern and material uncertainties; and

- events after the reporting date.

boards cannot predict the extent, duration and economic consequences of COVID-19 but it is reasonable to expect companies to articulate their expectations of the possible impacts on their specific business in different scenarios, including explaining the company’s resilience in face of uncertainty, the key assumptions and judgements used and availability of cash.

Additional measures to ease burdens on companies and auditors

Other measures in the statement intended to ease the burden on companies and auditors during this time are:

- Delaying the filing of accounts by companies - Companies House has granted a 3-month extension to the normal deadline for the filing of company accounts at Companies House. Companies will still have to apply for the 3-month extension to be granted, but those citing issues around coronavirus will be automatically and immediately granted an extension via a fast-tracked process.

- Postponement of auditor tenders - companies are encouraged to consider delaying planned tenders for new auditors, even when mandatory rotation is due.

- Postponement of audit partner rotation – key audit partners are required to rotate every 5 years. However, where there are good reasons, for example to maintain audit quality in current circumstances, the rotation can be extended to no more than 7 years. This needs to be agreed with the audit committee of any affected entity and does not need to be cleared with or approved by the FRC.

- Reduction of FRC demands on companies and audit firms - the FRC will, where possible, delay or extend the deadlines for consultations and consider how it can adjust its audit review work to reduce demands on audit firms.

- Extension of reporting deadlines for public sector bodies - HM Government is revising deadlines for reporting by a range of public bodies, which will also provide some relief to their auditors.

Other new sources of guidance

Corporate reporting

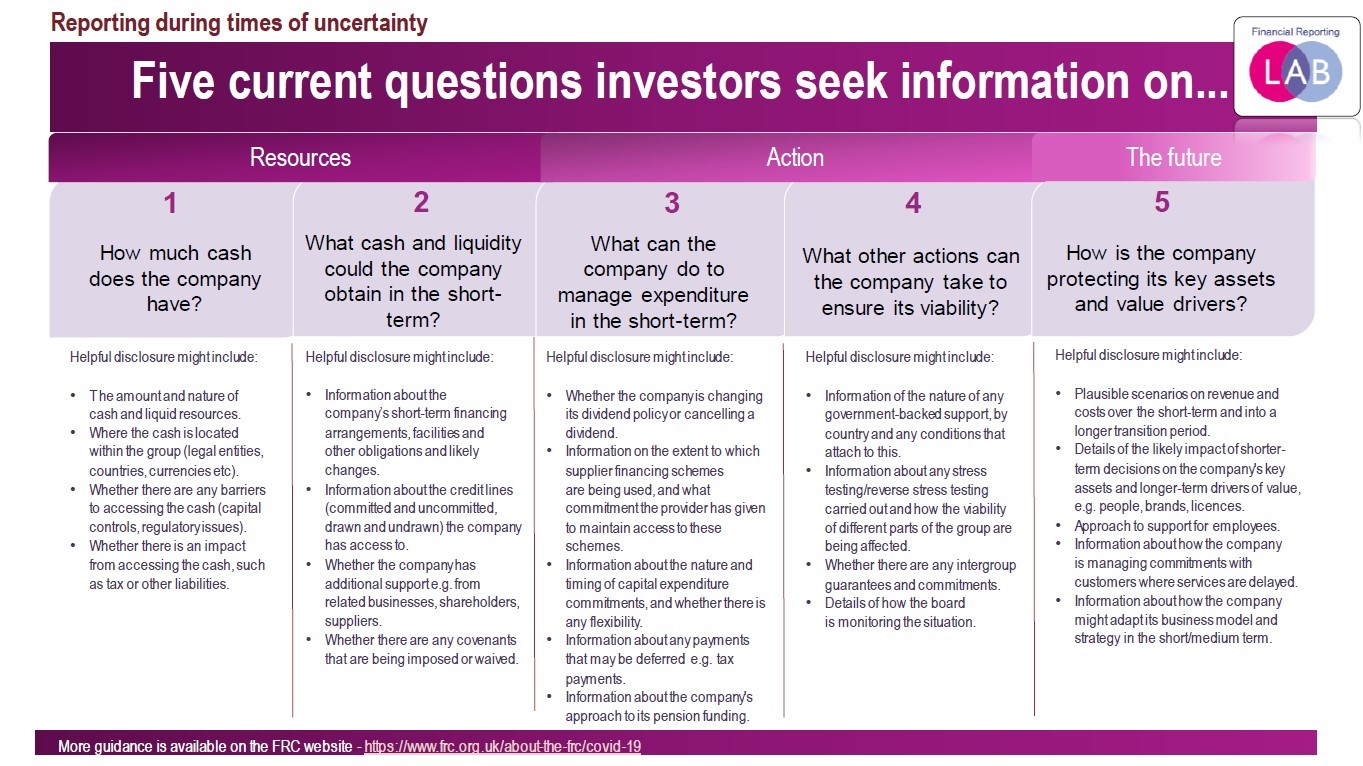

The FRC has published a COVID-19 infographic on reporting during times of uncertainty.

ICAS

- the impact of COVID-19 on holding AGMs

- Coronavirus and its impact on financial reporting

- FRC issues coronavirus guidance for auditors

Find out more on the Coronavirus Hub.