Technical and regulation queries

Do you have a question about accounting and auditing; ethics; anti-money laundering; practice support; insolvency; ICAS regulation or tax?

ICAS has a range of online resources and FAQs to help solve your problems.

If you can’t find what you are looking for in our online resources, you can contact our technical helpdesk using our digital portal. | |

|---|---|

To help us answer your query efficiently, use the table below to identify the appropriate team to deal with your question: | |

| Query | Team |

Financial reporting and audit including:

| Accounting and Auditing |

General practice questions including:

| Practice Support |

UK Tax

| Tax |

Code of Ethics (not audit/assurance related)

| Investigations |

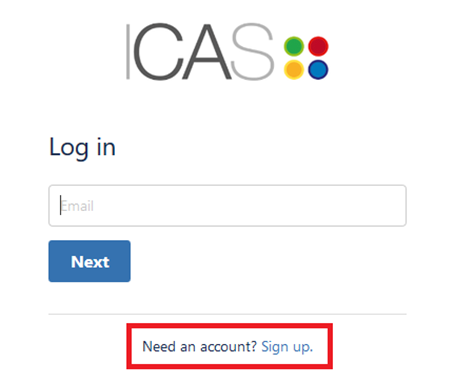

How to register and log on

Please note this is a separate registration and log-in from the ICAS member log-in.

Accessing the technical queries helpdesk

New users:

- Step 1 - Register here

- Click the ‘Sign up’ option as shown below.

Once registered

- Step 2 - Raise a technical query

ICAS Members also have access to the ICAEW Library & Information Service. This includes the enquiry service, book loans and document supply service but excludes access to online resources that are behind the ICAEW member login.

The small print

The service is primarily for ICAS members and member firms. Public requests are on a discretional basis.

If you are an ICAS student, queries on course material should be sent to the Education Support team. Technical matters relating to your employer or a work engagement should be escalated to your line management.

Our preference is for all queries (except for Regulation) to be logged using our Technical Helpdesk. However, if you have a general practice or insolvency question and need to speak with a member of our team you can also call 0131 347 0249.

If you have an ethical query (not related to audit or assurance work) you can also call our Ethical Helpline on 0131 347 0271 or email us.

We also offer the ICAS Ethics Buddy Service which enables Members with an ethical dilemma, where deemed appropriate, to have confidential, informal, discussions with an experienced Member in order to explore their issue and assist them in considering how they might approach their dilemma.

Our accounting and auditing and tax teams cannot provide opinions or offer advice but can help to signpost relevant guidance and information to enable members to form their own judgements.

The views expressed are the personal views of the sender and should not be taken to represent the views of the Institute. Neither ICAS nor its staff are liable for breach of contract, negligence (including negligent misstatement) or otherwise for:

- any loss resulting from any error, omission or inaccuracy in the information supplied; or

- any loss resulting from any act done (or not done) in the reliance on the information supplied.

We operate strict data security and confidentiality protocol. Please refer to our privacy policy.