The global significance of the economic sanctions and measures following Russia's 2022 invasion of Ukraine

Chris Wongsosaputro CA examines the global impact of the sanctions on Russia following the invasion of Ukraine.

The views contained in this article are the author's own in a personal capacity and do not necessarily reflect the views of ICAS.

The Russian invasion of Ukraine in 2022 has sparked far-stronger reactions from around the world vis-à-vis the annexation of Crimea in 2014.

As a starting point, the sanctions imposed in 2022 are more extensive in their extent and the number of countries involved. For instance, Japan, South Korea and Singapore did not sanction Russia over Crimea in 2014 while doing so in 2022.[1]

Moreover, the invasion has also united the EU and NATO’s resolve in applying economic sanctions and measures against Russia. For instance, Germany stopped the approval of the Nord Stream 2 gas pipeline following the invasion, marking a change from its initial hesitation pre-invasion.[2] This move is particularly significant given that Germany now obtains 55% of its gas supply from Russia, according to Economy Minister Robert Habeck.[3] Furthermore, Germany, Hungary and Italy also approved cutting off access to the SWIFT system for most Russian banks after initial doubts.[4]

The economic consequences of the invasion have also reverberated beyond Russia onto the rest of the world. One example is the downward revisions of 2022 growth by CNBC from 3.5% to 3.2% for the US and from 4.1% to 3.5% for Europe.[5] A recent Goldman Sachs analysis even indicated the probability of a US recession in the next year has increased up to 35%.[6]

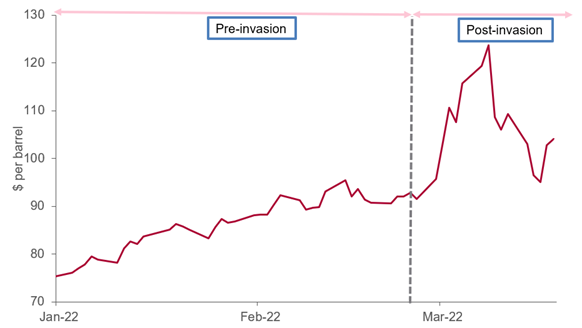

There has also been an uptick in oil prices which increased to $103 per barrel on 17 March (a peak of $124 reached on 8 March) v $93 on 24 February pre-invasion amid sanctions, COVID-19 and war-related supply chain disruptions as well as import bans by some Western nations.

Figure 1: WTI crude oil prices pre and post-invasion (up to 18 March) - source www.macrotrends.net

Besides oil, Russia is a major producer of commodities such as nickel, palladium, platinum (the latter two primarily used for vehicle catalytic converters) and potash (fertiliser). Meanwhile, Ukraine is a major producer of titanium[7] and grain.[8] The supply chain disruptions have exacerbated worldwide inflation concerns with the example of US Feb-22 inflation being at a 40-year high of 7.9%[9] while the OECD estimated impacts of c.2.5% on global inflation rate and (1.1)% on GDP growth.[10]

Given the inflationary concerns, Central Banks including the Fed and Bank of England implemented 0.25 percentage point base interest-rate increases in mid-March. The question is thus if and how fast further rate increases will be so as to balance taming inflation and maintaining economic growth.[11]

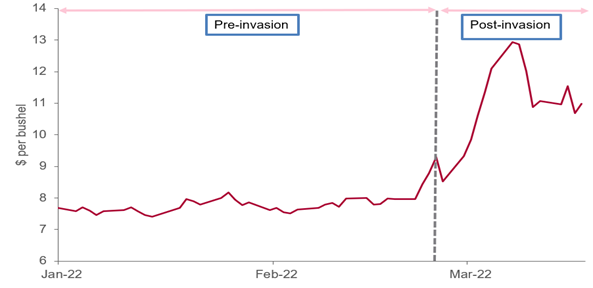

Prior to the invasion, the UN global food index has already risen by more than 40% over the last couple of years[12], driven by higher transport and energy costs, unfavourable weather trends, labour crunch and lower Russian exports[13]. The invasion will further impact the global food supply because of disruptions to food production and Russian blockade of Ukraine’s Black Sea interrupting trade. With Russia and Ukraine contributing a combined 29% of global wheat production, the UN’s Food and Agriculture Organisation (FAO) warned the invasion could increase food and feed prices by between 8% and 20%.

Estimates of the invasion’s impact on food poverty vary between c.10m by FAO[14] and c.40m people by the Centre for Global Development.[15]

Figure 2: Wheat prices per bushel pre and post-invasion (up to 17 March) - source www.macrotrends.net

Beyond the economy

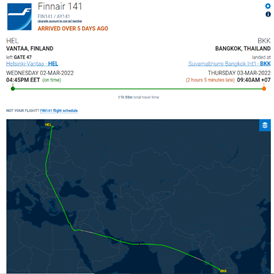

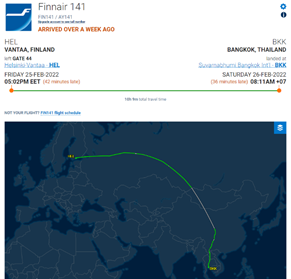

Beyond the economy, sanctions have impacted other areas of life including the West’s ban on Russian planes accessing its airspace and airports and vice-versa.[16] Consequently, some flight times and fuel consumption have increased with the example of Finnair flight between Helsinki and Bangkok taking c.2hours longer:

Figure 3: Finnair flight 141 between Helsinki and Bangkok - source flightaware

What next?

If the invasion were to drag on further, the scope and extent of current sanctions such as asset freeze and travel bans might be extended. The US and the EU also seek to regulate cryptocurrency to close potential sanction loopholes.[17]

EU countries might also consider cutting Russian oil purchases further and bringing forward their stated aim of phasing out Russian gas by 2030 if alternative energy sources were to be found.[18]British Prime Minister Boris Johnson had already kick-started the West’s efforts to diversify oil and gas supplies by visiting Saudi Arabia and the UAE on 16 March to discuss increasing oil and gas supplies.[19] Nonetheless, Western leaders remain wary about outright bans on Russian energy sources – British Chancellor Rishi Sunak estimated a c.£70bn damage (c.3% of GDP) to the UK economy and recession for Europe.[20]

Other potential developments impacting the future direction of measures include the use of chemical and biological weapons during the invasion[21] and whether EU members can agree on common measures. The latter factor has been evident from the onset of the invasion when Germany, Italy and Hungary were the last EU countries to oppose Russia’s removal from SWIFT. Further developments will also hinge on whether the Ukraine-Russia negotiations bear fruits including the possibility of Ukraine becoming a ‘neutral’ country in exchange for legally binding security guarantees.[22]

Going forward, it is likely for a different attitude towards receiving Russian investment (e.g. in property) to prevail in the West and vice-versa which will far outlast the invasion. This comes amid the Kremlin considering moves to nationalise properties belonging to Western firms who have left Russia.[23]

Outside the sphere of government, more companies might also withdraw from Russia given that some such as Subway, AstraZeneca, Renault and Accor are still operating in Russia as of 19 March.[24] Complete withdrawals from Russia might be complex for firms including M&S, Burger King and Marriott due to complications in their franchise agreements and ‘refusals’ from local partners to shut down operations.[25]

Beyond the short-term horizon, a likely long-term implication is the deepening of Russia-China bilateral ties. At the time of writing, major Russian banks are considering the use of China’s UnionPay to replace Visa and Mastercard[26] and reduce their reliance on the USD for international trade. Being shut off from SWIFT could also encourage more Russian banks to join the China National Advanced Payment System (CNAPS).[27]

Regarding energy, China is mulling over investing in Russian energy and commodity companies. [28] On 4 February, China National Petroleum Corporation signed a 25-year deal with Gazprom to supply an additional 10bn cubic metre of gas per year. [29]

Despite the possibility of enhanced ties, China is aware of its limitations due to the possibility of breaching Western sanctions which will hinder their access to Western markets.[30] The US has also warned China about repercussions in the event the latter extends financial and military aid to Russia which might impact Beijing’s calculus.[31] It also takes time for China to purchase the oil and gas which would otherwise have been sold to the West because of the time requirement for building a new pipeline. [32] The invasion has also raised the possibility of China as the holder of the world’s biggest foreign reserves re-considering its position on the reserves in the aftermath of the West’s sanctions on the Russian Central Bank reserves.[33]

Historian and author Yuval Noah Hariri also argued the invasion will have long-term ramifications on countries’ perceptions towards defence expenditure and arms supply to other countries.[34] For instance, Germany has increased defence spending from 1.5% to at least 2% of GDP in its 2022 budget. [35]

Conclusion

Based on the above, it is clear sanctions have had extensive consequences on ordinary people outside Russia such as inflation rising worldwide, global stock-market jitters and tit-for-tat airspace closures.

It is evident sanctions entail a price to pay so governments around the world need to be open and honest in their communications to the public about the costs of sanctions and assist in mitigating their impacts, especially via the upcoming Spring Statement in the UK’s case.

Beyond sanctions, the invasion has had a staggering toll on Ukraine with more than 3.3m people having left the country[36] and 1,500 civilian deaths[37] as of 19 March. Its economy is projected to decline between 10% and 35% in 2022 if the war becomes prolonged.[38] The world is also set to see a spike in food poverty the longer the invasion goes on.

Hence, there is a need for more-concerted aid efforts from wealthier nations and international organisations (e.g. the IMF and World Bank) to help Ukraine and countries facing higher food poverty.

References

[1] In rare stand, South Korea, Singapore unveil sanctions on Russia | Russia-Ukraine war News, Al Jazeera, https://www.aljazeera.com/economy/2022/2/28/in-rare-stand-south-korea-singapore-unveil-sanctions-on-russia

[2] Phillips, Alexa, Ukraine crisis: Germany halts approval of Nord Stream 2 gas pipeline from Russia | World News, skynews, https://news.sky.com/story/ukraine-crisis-germany-halts-approval-of-nord-stream-2-gas-pipeline-from-russia-12548612

[3] Knobbe, Martin and Traufetter, Gerald, Robert Habeck: "Russia Knows that Crossing Red Lines Would Immediately Trigger Painful Sanctions", SPIEGEL International, https://www.spiegel.de/international/germany/interview-with-economy-minister-robert-habeck-russia-knows-that-crossing-red-lines-would-immediately-trigger-painful-sanctions-a-907de5d5-f0d6-41a1-ae4d-89c997d46434

[4] Jankowicz, Mia, Tusk Slams Germany, Hungary, Italy Over Weak Russia Sanctions (businessinsider.com), Business Insider,https://www.businessinsider.com/tusk-slams-germany-hungary-italy-over-weak-russia-sanctions-2022-2

[5] Liesman, Steve, War fallout: U.S. economy to slow, Europe risks recession and Russia to suffer double-digit decline, cnbc.com, https://www.cnbc.com/2022/03/06/war-fallout-us-economy-to-slow-europe-risks-recession-and-russia-to-suffer-double-digit-decline.html

[6] Horowitz, Julia, Premarket stocks: Risk of a US recession as high as 35%, Goldman Sachs says, CNN Business, https://edition.cnn.com/2022/03/11/investing/premarket-stocks-trading/index.html

[7] Mineral Commodity Summaries 2021 (usgs.gov), U.S. Geological Survey, https://pubs.usgs.gov/periodicals/mcs2021/mcs2021.pdf

[8] Terazono, Emiko, Food crisis looms as Ukrainian wheat shipments grind to halt, Financial Times, https://www.ft.com/content/457ba29e-f29b-4677-b69e-a6e5b973cad6

[9] Smith, Colby and Duguid, Kate, US inflation reached 7.9% in February hitting new 40-year high, Financial Times, https://www.ft.com/content/93953231-469e-4a2d-b1c8-897ec679ed67

[10] OECD Economic Outlook, OECD, https://www.oecd.org/economic-outlook/

[11] Strauss, Delphine, Bank of England raises interest rates again to curb inflation, Financial Times, https://www.ft.com/content/d6cc373c-b45c-4c6e-821b-13f4f3bd3e32

[12] How Russia's invasion of Ukraine is tearing apart the global food system, The Straits Times, https://www.straitstimes.com/world/how-russias-invasion-of-ukraine-is-tearing-apart-the-global-food-system

[13] Russia could ban wheat, rye, barley and corn exports from March 15 to June 30 - AgMin, interfax.com, https://interfax.com/newsroom/top-stories/76687/

[14] UN agency warns Ukraine war could trigger 20% food price rise, The Straits Times, https://www.straitstimes.com/world/europe/un-agency-warns-ukraine-war-could-trigger-20-food-price-rise

[15] Mitchell, Ian, Hughes, Sam and Huckstep, Samuel, Price Spike Caused by Ukraine War Will Push Over 40 Million into Poverty: How Should We Respond?, Center For Global Development, https://www.cgdev.org/blog/price-spike-caused-ukraine-war-will-push-over-40-million-poverty-how-should-we-respond

[16] Hughes, David, ‘No better than North Korea’: Russian aviation faces wipeout | Russia-Ukraine war News, Al Jazeera, https://www.aljazeera.com/economy/2022/3/8/no-better-than-north-korea-russian-aviation-faces-wipeout

[17] Joe Biden to sign an executive order on crypto to stop Russia evading Ukraine war sanctions, Euronews, https://www.euronews.com/next/2022/03/08/joe-biden-to-sign-an-executive-order-on-crypto-to-stop-russia-evading-ukraine-war-sanction; Fleming, Sam, Oliver, Joshua and Politi, James, EU seeks to prevent use of crypto to avoid Russia sanctions, Financial Times, https://www.ft.com/content/325864c5-01c5-4373-bdd2-aaa56400b30b?fbclid=IwAR3lp5DU4eA976VmEJdTYz6igMwCp-qSGAzcrG7rOj2ojJCLyQhpctklxOs

[18] Weise, Zia and Wanat, Zosia, Commission plans to get EU off Russian gas before 2030, Politico, https://www.politico.eu/article/commission-plan-eu-russia-gas-2030/

[19] Hayward, Freddie, How phasing out Russian oil could deepen the cost-of-living crisis, New Statesman,https://www.newstatesman.com/politics/uk-politics/2022/03/how-phasing-out-russian-oil-could-deepen-the-cost-of-living-crisis

[20] Pickard, Jim and Giles, Chris, Sunak warns UK faces £70bn hit from EU ban on Russia oil and gas, Financial Times (ft.com), https://www.ft.com/content/70fc440a-4fb4-4d8f-93ab-888f68285131?fbclid=IwAR2b2BmDeRQkJu5upEtkwJcVURvwB2Xa_Db7vf47cetq50EyFww9QakjhtU

[21] Fossum, Sam and Klein, Betsy, Biden warns Russia will pay a 'severe price' if it uses chemical weapons in Ukraine, CNNPolitics, https://edition.cnn.com/2022/03/11/politics/joe-biden-warning-chemical-weapons

[22] Boffey, Daniel and Koshiw, Isobel, Russia and Ukraine ‘close to agreeing’ on neutral status, says Sergei Lavrov | Ukraine, The Guardian, https://www.theguardian.com/world/2022/mar/16/russia-and-ukraine-close-to-agreeing-on-neutral-status-says-sergei-lavrov

[23] Orru, Mauro, Legislative commission backs plan to nationalize property of Western companies exiting Russia, MarketWatch, https://www.marketwatch.com/story/legislative-commission-backs-plan-to-nationalize-property-of-western-companies-exiting-russia-11646858411

[24] Over 300 Companies Have Withdrawn from Russia - But Some Remain, Yale School of Management, https://som.yale.edu/story/2022/over-300-companies-have-withdrawn-russia-some-remain?fbclid=IwAR0EBwk2017qHG72ksirKsq_jJ3T3pUWjg8hM9CmYzQ-EhOfMeQmWqVUy3Q

[25] Race, Michael, The Western brands unable to leave Russia, BBC News, https://www.bbc.com/news/business-60733389

[26] Russian Banks Consider Using China's UnionPay; Big Accounting Firms Exit, Time,https://time.com/6155539/russian-banks-china-unionpay/

[27] Greene, Robert, How Sanctions on Russia Will Alter Global Payments Flows, Carnegie Endowment for International Peace, https://carnegieendowment.org/2022/03/04/how-sanctions-on-russia-will-alter-global-payments-flows-pub-86575

[28] China considers buying stakes in Russian energy, commodity firms, Financial Post, https://financialpost.com/commodities/energy/oil-gas/china-considers-buying-stakes-in-russian-energy-commodity-firms

[29] Shahbazov, Fuad, How Will the New China-Russia Gas Deal Affect the Ukraine Crisis?, Politics Today, https://politicstoday.org/how-will-the-new-china-russia-gas-deal-affect-the-ukraine-crisis/

[30] Power, John, As Russia’s isolation grows, China hints at limits of friendship | Russia-Ukraine war, Al Jazeera, https://www.aljazeera.com/economy/2022/2/28/as-russias-isolation-grows-china-hints-at-limits-of-friendship

[31] Ukraine crisis: US warns China against helping Russia, BBC News, https://www.bbc.com/news/world-asia-china-60732486

[32] Johnson, Ian and Huang, Kathy, Why China Is Struggling to Deal With Russia’s War in Ukraine, Council on Foreign Relations, https://www.cfr.org/in-brief/china-russia-war-ukraine-taiwan-putin-xi

[33] Rachman, Gideon, Xi Jinping faces a fateful decision on Ukraine, Financial Times (ft.com), https://www.ft.com/content/75701f79-2edd-4a46-98e7-620473ffabce

[34] Harari, Yuval Noah, Why Vladimir Putin has already lost this war, The Guardian, https://www.theguardian.com/commentisfree/2022/feb/28/vladimir-putin-war-russia-ukraine

[35] A big defence budget shows Germany has woken up, The Economist, https://www.economist.com/leaders/a-big-defence-budget-shows-germany-has-woken-up/21808225

[36] Haseman, Janie, Millions of Ukrainian refugees are fleeing: Where are they going?, USA Today, https://eu.usatoday.com/in-depth/graphics/2022/03/19/millions-ukrainian-refugees-fleeing-where-they-going-ukraine-war/7034809001/

[37] Conflict in Ukraine, Global Conflict Tracker (cfr.org), https://www.cfr.org/global-conflict-tracker/conflict/conflict-ukraine

[38] Elliott, Larry, Ukraine economy could shrink by up to 35% in 2022, says IMF, The Guardian, https://www.theguardian.com/business/2022/mar/14/ukraine-economy-shrink-2022-imf-russia-war