In detail: Key announcements in the Autumn Statement

Our experts have provided detail on the key announcements within the Autumn Statement.

Commenting on today’s Autumn Statement by Chancellor Jeremy Hunt, Bruce Cartwright CA, ICAS CEO said: “This is a statement full of mixed messages. Of course, it’s good to see measures to support those on the lowest incomes such as raising the national minimum wage, but it’s Britain’s small businesses who will carry the burden of this increase, not the government.”

Reduction in Class 1 National Insurance

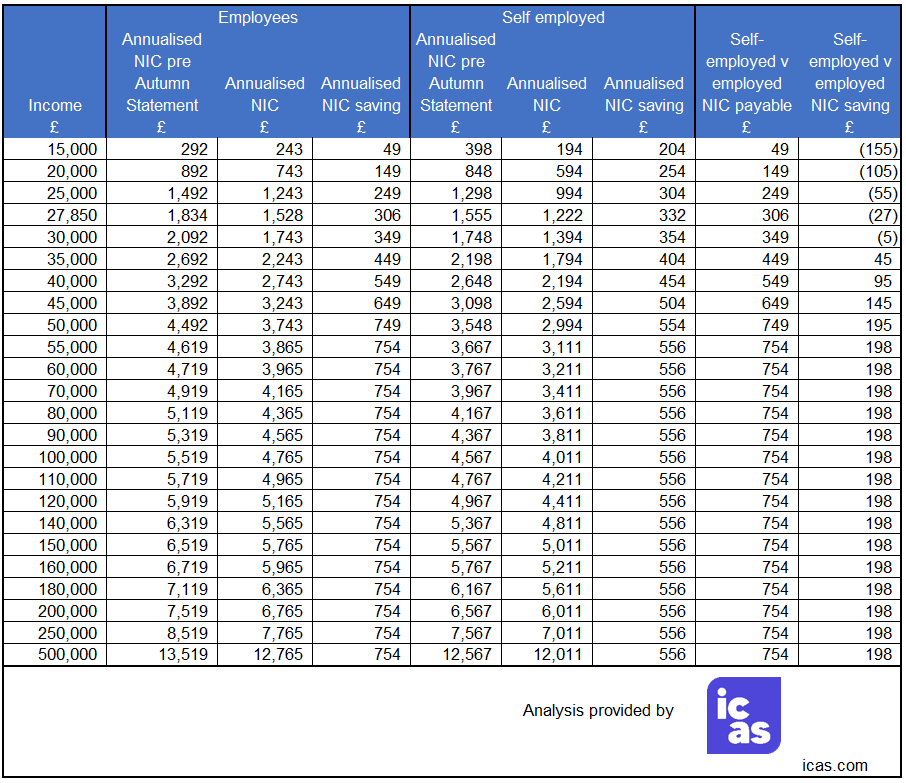

On the 2% reduction in primary National Insurance Contributions (NICs) Justine Riccomini, Head of Tax (Employment and Devolved Taxes) at ICAS, said: "The reduction of NICs from 12% to 10% means an across the board saving for anyone below state pension age, earning above £12,570 per annum. This will put cash directly in peoples’ pockets, regardless of where they are employed in the UK. Someone earning the new level of National Living Wage in 2024 of £11.44 (for 21 and over), which is a 9.8% increase on last year, will now earn £20,820 as a full time equivalent. The reduction to NICs will also afford them a further £165 in savings. Similarly, an employee earning £40,000 per year will save around £550 a year in NICs."

See PDF version of above table here.

Abolition of Class 2 National Insurance and reduction in Class 4 National Insurance

On the abolition of Class 2 NICs Justine Riccomini, Head of Tax (Employment and Devolved Taxes) at ICAS, said: "The abolition of the Class 2 weekly National Insurance charge of £3.45 a week will be welcomed by the self-employed as it represents a simplification of their affairs, as well as an annual saving of around £192 a year. Combined with the reduction in Class 4 NICs to 8%, this should save the average self-employed worker £353.70, while someone on a salary of £30,000 will save £349. However, anyone earning profits above £30,000 won’t see the same level of benefit as someone on a salary over £30,000.

Unincorporated businesses which do not have a 5 April/31 March year end will be dealing with the impact of basis period reform in the 2023/24 tax year, although as the change is taking effect from January 2024, the impact of basis period reform to the National Insurance changes is likely to be limited.”

Corporation Tax full expensing

On Corporation Tax full expensing, Chris Campbell, Head of Tax (Tax Practice and Owner Managed Business Taxes) at ICAS, said: "Applying full expensing permanently will give companies greater confidence about the tax relief they will receive on planned capital spending. However, we need assurances that this change will last beyond the current government. Of course, we shouldn’t forget that the government claws back capital allowance relief once the company sells those assets which qualified for full expensing.

The Chancellor previously announced that full expensing would apply for expenditure incurred until 31 March 2026. Extending full expensing will make planning easier and encourage investment in new plant and machinery. Because smaller companies may be able to rely on annual investment allowance (up to £1million pa), extending full expensing is likely to benefit larger companies more, as they tend to make longer-term, large-scale capital purchases.”

HMRC resources

The chancellor may have talked about giving HMRC extra resources to help them collect the £5bn outstanding estimated tax gap over the next 5 years. However, this will be largely absorbed by HMRC’s debt collection activity rather than being directed towards improving HMRC service standards. Our members need to be able to contact HMRC so that tax is correctly calculated in the first place.

Research and Development tax relief

On research and development tax relief Susan Cattell, Head of Tax Technical Policy at ICAS, said: “We are pleased that the Chancellor has confirmed that a merged scheme for R&D tax relief will go ahead, but we feel that the start date of April 2024 is too soon and would have preferred more time for consultation on the details. We support a simpler, single scheme that would be easier for companies to deal with, reducing the scope for error and (alongside other compliance measures) limiting opportunities for abuse. However, there will clearly be some additional complexity arising from the additional relief for R&D intensive SMEs which was only introduced from April 2023 - but will change from April 2024.”

Making Tax Digital for Income Tax Self-Assessment

The Chancellor's decision to not extend the requirements of MTD ITSA to self-employed taxpayers and landlords with income below £30,000 at this time is welcome. The position for self-employed taxpayers and landlords with income below £30,000 will continue to be kept under review. ICAS will continue to represent the views of our members as part of our engagement with HMRC as a trusted stakeholder.

Chris Campbell, Head of Tax (Tax Practice and Owner Managed Business Taxes) at ICAS said: "Although we support digital interaction with HMRC, we’re not fully convinced that the benefits of quarterly reporting outweigh the costs of doing this, particularly for the smallest of businesses. So, leaving the income threshold at £30,000 for now is welcome news. We would have liked the Chancellor to go further, so that the quarterly reporting requirement won’t apply to self-employed businesses and landlords with income below the VAT registration threshold (currently £85,000). This would have ensured the additional burden would largely fall on only those unincorporated businesses who are already dealing with MTD for VAT."

Improving standards in the tax advice market

On the lack of measures to improve standards in the tax advice market Susan Cattell, Head of Technical Policy at ICAS, said: “We had hoped that the expected consultation on options for the regulation of the tax advice market and a definition of tax advice would be published. While helpful measures were taken earlier this year to protect taxpayers using repayment agents, these only tackled part of a wider problem, so it’s disappointing that there was no announcement on this.

In the long term we believe the only effective way to protect anyone paying for tax services is to introduce a requirement that anyone acting as a tax agent should be qualified and should belong to one of the main professional bodies that subscribe to and enforce Professional Conduct in Relation to Taxation (PCRT).”